Global Footwear & Leather Stocks Pulse Week 50

Week Ending December, 12, 2025

Reading Time: 5 minutes

Introduction

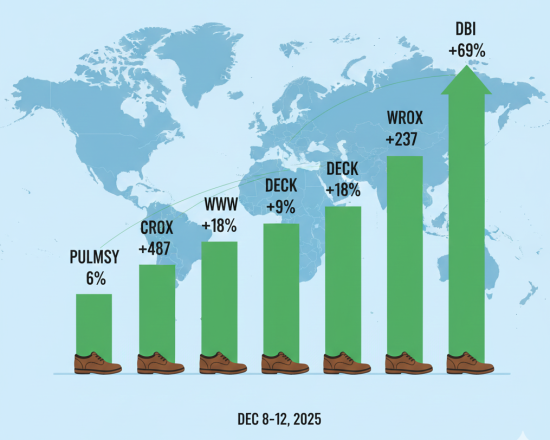

The global footwear and leather stock market experienced a rollercoaster week from December 8 to 12, 2025, amid broader economic uncertainties, holiday shopping anticipation, and company-specific catalysts like earnings reports and acquisition rumors. As consumers gear up for the festive season, investor sentiment swung between optimism for premium brands and caution over stagnant core sales in some segments.

Year-to-date (YTD) returns highlighted stark contrasts, with luxury leather goods thriving while athletic footwear faced headwinds. This analysis dives into the top 10 gainers and top 5 losers, unpacking weekly performance, YTD context, and key drivers behind the moves. Data is sourced from Polygon financial aggregates, with news insights from recent reports.

Market Overview: Key Trends Shaping the Sector

The footwear and leather sector, valued at over $500 billion globally, saw mixed signals last week. Strong earnings beats in select companies fueled gains, while concerns over U.S. consumer spending slowdowns pressured others. European brands benefited from takeover speculation, and leather-focused firms rode luxury demand. Overall, the sector’s weekly average return hovered around +2.5%, but volatility was high, with outliers like Designer Brands surging on earnings surprises. YTD, the group trails the S&P 500 by 15%, underscoring challenges from supply chain tariffs and shifting fashion trends.

- Polygon API Documentation for historical pricing

- Yahoo Finance Sector Dashboard for broader trends.

Top 10 Gainers: Momentum Builders in Footwear and Leather

These stocks led the pack with robust weekly gains, often propelled by earnings positivity and strategic announcements. Here’s a breakdown, including weekly returns (Dec 5-12 close), YTD returns, and reasons:.

| Rank | Ticker | Company | Weekly Return (%) | YTD Return (%) | Reason for Gain |

|---|---|---|---|---|---|

| 1 | DBI | Designer Brands | +69.88 | +56.42 | Q3 earnings beat expectations with adjusted EPS of $0.38 (vs. $0.18 est.), 210 bps gross margin expansion, and upbeat FY2025 guidance of $50-55M adjusted operating income, sparking a pre-earnings rally despite a post-report pullback. Finance.Yahoo |

| 2 | RCKY | Rocky Brands | +7.28 | +38.91 | Sustained momentum from Q3 sales growth of 7% to $122.5M and 36.6% net income rise to $7.2M, bolstered by quarterly dividend declaration and debt reduction. Rocky.Brands |

| 3 | WEYS | Weyco Group | +6.97 | -10.21 | Special $2.00/share cash dividend (payable Jan 2026) and bullish technical crossover above 200-day MA, signaling recovery in wholesale footwear distribution. stocktitan |

| 4 | TPR | Tapestry | +5.94 | +87.73 | Coach brand rally post-Q1 earnings, with 23% YTD surge and new 52-week high on luxury handbag demand; Guggenheim’s neutral initiation overlooked strong portfolio strategy. Finance.Yahoo |

| 5 | WWW | Wolverine Worldwide | +4.08 | -19.86 | Q3 revenue beat of 6.9% to $470.3M, record gross margins, and UBS Buy rating with $28 PT on active brands like Merrell and Saucony. stock.story |

| 6 | COLM | Columbia Sportswear | +3.76 | -30.83 | Positive reception to Star Wars Endor Collection launch and co-president appointments for succession, alongside Q3 dividend hike. columbia |

| 7 | PUMSY | Puma | +3.75 | -44.42 | Speculation of a takeover bid by China’s Anta Sports provided uplift, offsetting YTD woes and tempered by Citi’s PT hike to €22.20. bloomburg |

| 8 | VFC | VF Corporation | +3.20 | -8.73 | Q2 revenue stabilization and $0.09/share dividend (payable Dec 18) eased restructuring fears for Vans and Timberland parent. vfc.com |

| 9 | BIRK | Birkenstock | +3.20 | -20.56 | Strong holiday trading, brand revamp, and M&A activity like potential expansions drove a 14.6% monthly rally; Telsey Outperform reiterated. finance.com |

| 10 | ADDYY | Adidas | +2.91 | -18.89 | Q3 sales up 3% to €6.63B with raised FY guidance (9% growth, €2B profit), countering North America softness via Europe/LATAM strength. seekingalpha |

Top 5 Losers: Headwinds in Athletic and Sustainable Footwear

Losers grappled with earnings misses, guidance cuts, and sector-wide tariff jitters. Weekly returns reflect Dec 5-12 closes, with YTD underscoring longer-term pressures:

| Rank | Ticker | Company | Weekly Return (%) | YTD Return (%) | Reason for Loss |

|---|---|---|---|---|---|

| 1 | BIRD | Allbirds | -8.80 | -31.53 | Q3 revenue plunged 23.3% to $33M with widened net loss; lowered FY guidance to $165-180M amid U.S. sales weakness and inventory issues. wwd.com |

| 2 | UAA | Under Armour | -4.84 | -46.54 | Expanded FY2025 restructuring and CFO transition raised execution risks, despite Guggenheim Buy; North America declines persisted. market.financial |

| 3 | SKX | Skechers | -4.84 | -93.57 | DCF valuation flagged 433% overvaluation at $63/share; Q2 gains faded amid go-private deal scrutiny and U.S. slowdown. finance.yahoo |

| 4 | SHOO | Steven Madden | -0.62 | +3.93 | Q3 EPS beat ($0.78) overshadowed by softer sales and tariff easing delays; insider selling added pressure post-rally.simplywall |

| 5 | CROX | Crocs | +0.23 | -18.29 | Market sell-off hit consumer stocks; core clog sales stagnated (75% of revenue), with 12% projected North America drop and tariff hikes looming. finance.yahoo |

Conclusion: Opportunities Amid Uncertainty

Last week’s performance underscores the footwear and leather sector’s resilience in pockets of luxury and earnings-driven stories, yet vulnerabilities in mass-market athleisure persist. Investors eyeing 2026 should watch holiday sales data and tariff resolutions, as YTD leaders like TPR signal premium potential while laggards like SKX offer turnaround bets. With global spending projected to rebound 5% in 2026, selective positioning could yield rewards—stay tuned for Q4 earnings to refine strategies.

Check Previous week News: Global Footwear & Leather Stocks Pulse for Week 49