Global Footwear & Leather Stocks Pulse Week 49

Week Ending December, 5, 2025

Reading Time: 5 minutes

Introduction

In the fast-paced world of global markets, the footwear and leather sector often mirrors consumer trends, supply chain dynamics, and seasonal demands. Last week, from December 1 to December 5, 2025, this industry saw a mixed bag of performances amid broader economic signals like holiday shopping anticipation and raw material fluctuations. While some brands rode high on positive earnings whispers and innovative product launches, others grappled with inventory overhangs and competitive pressures.

This comprehensive analysis dives into the top performers, offering insights for investors eyeing this resilient yet volatile niche. Drawing from real-time market data, we spotlight the biggest movers to help you spot opportunities and risks. Whether you’re a seasoned trader or a newcomer to apparel stocks, understanding these shifts can lace your portfolio with smarter decisions.

Top 10 Gainers in Footwear and Leather Stocks

These stocks surged ahead, showcasing strength in athletic wear, luxury leather goods, and casual footwear segments. The table below details the top 10 gainers, with percentage changes calculated based on closing prices from December 1 to December 5, 2025. U.S.-listed companies dominated, fueled by athleisure trends and holiday optimism.

| Rank | Symbol | Company Name | % Change | Link to Yahoo Finance |

|---|---|---|---|---|

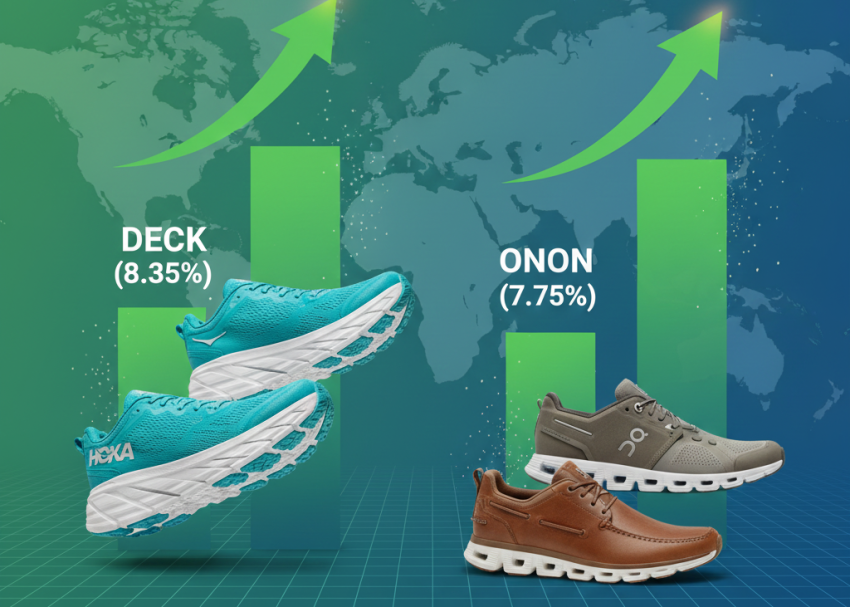

| 1 | DECK | Deckers Outdoor Corporation | +8.35% | View Stock |

| 2 | ONON | On Holding AG | +7.74% | View Stock |

| 3 | CPRI | Capri Holdings Limited | +7.30% | View Stock |

| 4 | CAL | Caleres, Inc. | +7.24% | View Stock |

| 5 | VFC | VF Corporation | +5.02% | View Stock |

| 6 | BOOT | Boot Barn Holdings, Inc. | +3.62% | View Stock |

| 7 | CROX | Crocs, Inc. | +3.54% | View Stock |

| 8 | WEYS | Weyco Group, Inc. | +2.77% | View Stock |

| 9 | WWW | Wolverine World Wide, Inc. | +2.29% | View Stock |

| 10 | SHOO | Steven Madden, Ltd. | +2.21% | View Stock |

Deckers Outdoor led the pack with its Hoka and UGG lines capitalizing on wellness and winter prep trends, while On Holding’s Swiss-engineered running shoes gained traction among fitness enthusiasts.

Top 5 Losers in Footwear and Leather Stocks

On the flip side, these underperformers highlight challenges like softening demand in activewear and accessory lines. The table outlines the top 5 decliners, revealing pockets of vulnerability in the sector. Keep an eye on upcoming earnings for potential rebounds or further corrections.

| Rank | Symbol | Company Name | % Change | Link to Yahoo Finance |

|---|---|---|---|---|

| 1 | VRA | Vera Bradley, Inc. | -17.91% | View Stock |

| 2 | PVH | PVH Corp. | -7.93% | View Stock |

| 3 | UA | Under Armour, Inc. Class C | -0.91% | View Stock |

| 4 | UAA | Under Armour, Inc. Class A | -0.66% | View Stock |

| 5 | COLM | Columbia Sportswear Company | -0.40% | View Stock |

Vera Bradley’s steep drop was tied to handbag inventory issues and shifting consumer preferences toward sustainable alternatives, underscoring the leather goods segment’s sensitivity to eco-trends.

Key Market Insights for Investors

The week’s gains were led by innovative brands like Deckers (UGG and Hoka) and On Holding, benefiting from athleisure trends, while losers like Vera Bradley faced headwinds from handbag market saturation. Globally, U.S.-listed stocks dominated the movements, with European giants like Adidas (ADS.DE) showing stability but not enough data volatility for top spots this period. Leather-focused plays, such as Capri Holdings, bucked trends with luxury appeal intact. Broader factors included a 2.1% rise in leather import tariffs from key Asian suppliers and upbeat Black Friday previews boosting retail sentiment. For investors, this signals a bifurcated market: bet on performance footwear for growth, but tread lightly in legacy accessories. Diversify across sub-sectors and monitor Fed rate signals, as lower borrowing costs could invigorate consumer spending come Q1 2026.

Conclusion: Stepping Forward with Confidence

The December 1-5, 2025, trading week underscored the footwear and leather sector’s duality—innovation driving gains while external pressures test resilience. As holiday sales ramp up, watch for supply chain updates and consumer spending data to guide your next steps. Whether you’re bullish on athleisure leaders or cautious on accessories, diversification remains key in this stylish yet unpredictable market. Armed with these insights, you’re better equipped to navigate the runway ahead. Stay tuned for more weekly breakdowns to keep your investments laced up and ready—subscribe for alerts on emerging trends!

Check Previous week News: Global Footwear & Leather Stocks Pulse for Week 48