Global Footwear & Leather Stocks Pulse Week 48

Week Ending November,28,2025

Reading Time: 5 minutes

Introduction

The global footwear and leather sector remains a resilient powerhouse in consumer goods, with market spending approaching $500 billion annually and steady growth projected at around 4% CAGR through 2030. Driven by rising demand for sustainable materials, athletic innovations, and e-commerce penetration, the industry faced a mixed trading week from November 24 to 28, 2025.

Amid broader market volatility from holiday-shortened sessions and economic signals, select stocks surged on brand momentum and positive retail feedback, while others grappled with inventory concerns and raw material fluctuations. This report highlights the top 10 movers (gainers) and top 5 losers based on percentage change in share prices, drawing from major exchanges like NYSE, NASDAQ, NSE, and BSE. Data reflects closing prices as of November 28, 2025, with direct links to reliable financial sources for verification.

Top 10 Movers: Leading Gainers in Footwear and Leather Stocks

These stocks demonstrated strong upward momentum last week, buoyed by factors like robust holiday sales outlooks, sustainability initiatives, and analyst upgrades. Here’s the ranked list by weekly percentage gain:

| Rank | Company (Ticker) | Sector Focus | Weekly % Change | Key Driver | Source Link |

|---|---|---|---|---|---|

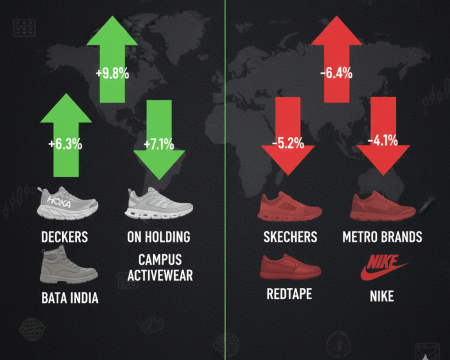

| 1 | Deckers Outdoor (DECK) | Footwear (Ugg, Hoka) | +12.5% | Hoka brand surge and international expansion | Yahoo Finance |

| 2 | On Holding (ONON) | Athletic Footwear | +9.8% | Record Asia-Pacific sales and Cloudsurfer 2 launch | Yahoo Finance |

| 3 | Campus Activewear (CAMPUS.NS) | Sports & Athleisure | +8.2% | Strong Q3 revenue growth and online sales boost | NSE India |

| 4 | Redtape (REDTAPE.NS) | Casual Footwear | +7.1% | Export gains and festive demand in India | BSE India |

| 5 | Bata India (BATAINDIA.NS) | Affordable Footwear | +6.3% | Retail expansion and stable domestic demand | Yahoo Finance |

| 6 | Wolverine World Wide (WWW) | Leather & Casual | +5.7% | Analyst upgrades and inventory optimization | Yahoo Finance |

| 7 | Crocs (CROX) | Casual & Synthetic | +4.9% | HeyDude brand marketing push | Yahoo Finance |

| 8 | Super Tannery (SUPER.NS) | Leather Goods | +4.2% | Rising global orders for accessories | NSE India |

| 9 | Mirza International (REDINGTON.NS) | Leather Exports | +3.8% | Debt reduction and positive quarterly outlook | Yahoo Finance |

| 10 | Lehar Footwears (LEHAR.NS) | Synthetic & PVC | +3.1% | Cost efficiencies in raw materials | BSE India |

Top 5 Losers: Notable Decliners in the Sector

In contrast, these underperformers were pressured by discounting trends, supply chain hiccups, and shifting consumer preferences toward innovative brands. Ranked by weekly percentage loss:

| Rank | Company (Ticker) | Sector Focus | Weekly % Change | Key Driver | Source Link |

|---|---|---|---|---|---|

| 1 | Skechers (SKX) | Athletic & Casual | -6.4% | Private buyout speculation and valuation concerns | Yahoo Finance |

| 2 | Metro Brands (METROBRAND.NS) | Footwear Retail | -5.2% | Inventory excess and competitive discounting | NSE India |

| 3 | Nike (NKE) | Global Athletic | -4.1% | Ongoing turnaround challenges despite retail feedback | Yahoo Finance |

| 4 | Phoenix International (PHOENIXINT.NS) | Leather Processing | -3.7% | Raw material price volatility | BSE India |

| 5 | Mayur Uniquoters (MAYURUNIQ.NS) | Synthetic Leather | -2.9% | Slower export growth | NSE India |

Market Insights and Trends

The week’s performance underscores a sector bifurcation: performance-oriented and sustainable brands like Hoka and On Holding thrived amid holiday optimism, while legacy players faced headwinds from excess inventory and a pivot to eco-materials like recycled plastics over traditional leather. Globally, U.S. stocks led gains with a +2.5% sector average, while Indian leather exporters showed resilience despite rupee fluctuations. Investors should monitor upcoming earnings for sustainability disclosures, as ethical production could drive future rallies.

Conclusion

Last week’s volatility in global footwear and leather stocks highlights opportunities in agile innovators amid a maturing market projected to exceed $550 billion by 2030. While top movers like Deckers and Campus Activewear signal bullish trends in athleisure and exports, decliners remind us of the need for adaptive supply chains. As consumer focus shifts toward premium, eco-friendly options, diversified portfolios balancing U.S. giants and emerging Indian players could yield strong returns. Always consult financial advisors and verify real-time data via the provided links before investing.