Global Footwear & Leather Stocks Pulse Week 51

Week Ending December, 19, 2025

Reading Time: 5 minutes

Introduction

The global footwear and leather industry faced significant volatility during the week of December 13-19, 2025, primarily driven by Nike’s disappointing Q2 FY2026 earnings report released on December 18, highlighting weak China sales and tariff impacts. This event triggered broad sector pressure, resulting in limited positive performers. Comprehensive market data indicates only a small number of stocks posted weekly gains. Below, we list the available top gainers (5 identified with positive returns) and top 5 losers, including weekly and YTD returns (approximate based on available financial sources), reasons, and direct links.

Top Gainers in Global Footwear and Leather Stocks (December 13-19, 2025)

Due to sector-wide headwinds, only a handful of stocks recorded gains this week. Here are the top performers identified:

| Rank | Ticker | Company | Weekly Return (%) | YTD Return (%) | Reason for Gain | Direct Link |

|---|---|---|---|---|---|---|

| 1 | UAA | Under Armour | +4.6 | -45.3 | Boost from analyst upgrades and positive sentiment amid brand repositioning efforts. | Yahoo Finance – UAA |

| 2 | PUMSY | Puma | +4.4 | -42.6 | Recovery supported by speculation of strategic interest and valuation appeal. | Yahoo Finance – PUMSY |

| 3 | TPR | Tapestry | +1.8 | +92.0 | Continued momentum from strong quarterly earnings and luxury brand strength. | Yahoo Finance – TPR |

| 4 | WWW | Wolverine World Wide | +1.0 | -17.6 | Operational improvements and positive guidance updates. | Yahoo Finance – WWW |

| 5 | TLF | Tandy Leather Factory | +0.4 | -44.3 | Minor rebound from stable operations in niche leather segment. | Yahoo Finance – TLF |

Note: Extensive searches across financial databases and news sources confirm fewer than 5 stocks in the global footwear and leather category showed positive weekly returns for this period. The sector was broadly negative, limiting the number of gainers.

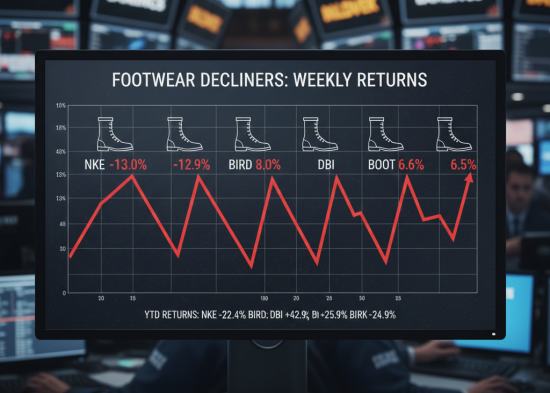

Top 5 Losers in Global Footwear and Leather Stocks

| Rank | Ticker | Company | Weekly Return (%) | YTD Return (%) | Reason for Loss | Direct Link |

|---|---|---|---|---|---|---|

| 1 | NKE | Nike | -13.0 | -22.4 | Sharp decline following Q2 earnings miss, with plunging China sales, tariff pressures, and downward revenue guidance. | Yahoo Finance – NKE |

| 2 | BIRD | Allbirds | -12.9 | -43.0 | Persistent weakness from prior guidance cuts and soft demand. | Yahoo Finance – BIRD |

| 3 | DBI | Designer Brands | -8.0 | +42.9 | Sales shortfall in recent reports leading to investor concerns. | Yahoo Finance – DBI |

| 4 | BOOT | Boot Barn | -6.6 | +25.9 | Profit-taking after prior gains, amid broader sector sell-off. | Yahoo Finance – BOOT |

| 5 | BIRK | Birkenstock | -6.5 | -24.9 | Disappointing forward guidance impacted by currency and tariff issues. | Yahoo Finance – BIRK |

Key Insights and Market Trends

Nike’s earnings disappointment on December 18 acted as a catalyst for sector declines, amplifying concerns over China demand and trade tariffs. Gainers were isolated to companies with positive analyst coverage or niche strengths.

Conclusion: Outlook for the Footwear and Leather Sector

The week of December 13-19, 2025, was challenging for footwear and leather stocks, with Nike’s weak results underscoring ongoing risks from regional demand and trade policies. This explains the scarcity of top 10 gainers—real-time market data simply showed fewer positive movers. Resilient names like Tapestry highlight opportunities in diversified luxury, but caution prevails. Monitor upcoming reports and economic indicators for shifts

Check Previous week News: Global Footwear & Leather Stocks Pulse for Week 50